SWIFT Code / BIC Bank Checker Online For Any Bank - Jack

Check SWIFT/BIC Codes Online

The easiest way to find the right SWIFT/BIC code for your international transfer is right here. Quickly search SWIFT/BIC code by bank or country to find the right bank or branch, or use our online SWIFT/BIC checker tool to ensure its accuracy.

Check a SWIFT/BIC Code

Input SWIFT / BIC code to check, and find which bank has that code.

Enter a SWIFT code

Find a SWIFT/BIC Code

Just input the country and bank details below.

Select a country

Select a country

Popular SWIFT Code in Indonesia

SWIFT code Bank Mandiri

SWIFT code Bank Negara Indonesia (BNI)

SWIFT code Bank Central Asia (BCA)

SWIFT code Bank Rakyat Indonesia (BRI)

SWIFT code Bank CIMB Niaga

Popular SWIFT Code in Singapore

SWIFT code DBS Bank Limited

SWIFT code United Overseas Bank (UOB) Limited

SWIFT code Oversea-Chinese Banking Corporation (OCBC) Limited

SWIFT code Citibank Singapore LTD

SWIFT code HSBC Bank

What is a SWIFT/BIC Code?

A SWIFT (Society for Worldwide Interbank Financial Telecommunications) code, also known as a BIC (Bank Identifier Code), is a unique identifier code for banks and financial institutions globally. It helps them communicate securely and quickly when they need to send money to each other, especially for international transfers.

Another purpose of the SWIFT code is to reduce the operational risk when making transactions by setting a standard and minimizing the amount of transaction fee. Each bank has its own unique SWIFT code, which acts as an identifier, making sure the money goes to the right place. It's a bit like a postal code for banks!

When Do You Need a SWIFT/BIC Code?

If you're sending or receiving international bank transfers, particularly wire transfers or SEPA payments, you may likely be requested to provide a SWIFT/BIC code. SWIFT codes assist financial institutions in the processing of international transfers.

Where Can I Find the Right SWIFT/BIC Code?

You can find the right bank's SWIFT/BIC code within the bank account statement. You may also utilize our SWIFT/BIC lookup tool to obtain the precise code for your transfer.

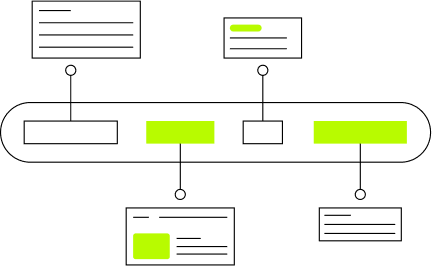

How is the Structure of a SWIFT/BIC Code?

For a transaction to succeed, the customer is required to know the SWIFT code. The SWIFT code is always located at the front of your bank account number.

Different from the bank code that is made of 3 digits numbers, a SWIFT code is a combination of capital letters and numbers that make between 8 and 11 digits that identifies the country, city, bank, and branch.